Meal & incidental expense per diem allowance

Individual University business travelers are eligible to receive a meal & incidental expense (M&IE) per diem allowance whenever travel requires an overnight stay. The M&IE per diem allowance covers individual, out-of-pocket meals and incidental expenses.

The M&IE per diem allowance includes all meals as well as incidental expenses defined as:

- Fees and tips given to restaurant wait staff, bell hops, porters, baggage handlers, hotel housekeeping, valet, service staff on trains or ships.

- Transportation between places of lodging or business and places where meals are taken.

- Laundry, dry cleaning, and pressing of clothing

- Mailing and other expenses associated with filing expense reports

- Bottled water (for international travel needs)

Day trip travel without an overnight stay does not qualify for the M&IE per diem allowance. If your day travel requires you to spend money for a meal(s), the approving authority may authorize a $15 day trip meal allowance. This allowance is tax reportable to you.

The M&IE per diem allowance does not require receipts for payment. Do not submit receipts to the University for M&IE per diem. The I.R.S. does recommend that all business travelers retain receipts for any business travel expenses incurred for personal tax filing purposes.

No. A M&IE per diem allowance is only allowed for individual travelers that incur meal and incidentals expenses as a result of over-night travel, pay out-of-pocket and file for their own reimbursement. If a student traveler does the above, they would file for their own M&IE per diem reimbursement. If you continue to provide this for the student, they cannot.

When a University group leader provides money to students (or members of a team) for purchase of their own meal the expense limits fall under the same limit structure as Headquarter City and UW Sponsored Events. The amount of meal money given should be reasonable and in keeping to the type of student activity/travel and meals being provided.

All meal expenses must be supported by itemized receipts. In cases where meal money is given to students to purchase a meal on their own, the standard signature form, signed by the student to acknowledge the receipt of meal money, will be used in lieu of the restaurant receipt.

The maximum rates, including gratuity and tax, by location and meal expense type are:

Expense | Within Wisconsin | Outside Wisconsin |

Breakfast | $12 | $15 |

Lunch | $18 | $23 |

Dinner | $30 | $37 |

Refreshments/Break | $10 | $10 |

An individual traveler’s personal meal & incidental expense (M&IE) per diem allowance cannot be used to pay for items related to University Sponsored Events or any other related business entertainment activity that includes meals, food or beverages whether the expense is incurred in travel status or at the headquarter location.

Meal limits, receipt requirements and other documentation for hosting expenses is part of the UW Headquarter City & Sponsored Events policy. Please review the requirements.

Yes, the M&IE per diem allowance is applicable to all individuals that travel for University purposes.

Headquarter city & UW sponsored events

No. When making food and beverage arrangements you do not have to spend the maximum amount per meal. Let the food and beverage staff know what your budget is and request food and beverage options that align with your budget. If you are accustomed to using a hotel’s “state rate menu” to stay within your budget, you can continue to request that.

These type of meal expenditures are considered “hosted meals”. Meal maximums and policy requirements for hosting a meal are the same as what is contained within the Headquarter City and UW Sponsored Events Policy.

All hosted meal expenses must be supported by a business purpose, itemized receipts and a list of attendees. The meal purchase(s) should be reasonable, need not be at the maximum amount, and in keeping with the type of student activity/travel and meals being provided.

The maximum rates, including gratuity and tax, by location and meal expense type are:

Expense | Within Wisconsin | Outside Wisconsin |

Breakfast | $12 | $15 |

Lunch | $18 | $23 |

Dinner | $30 | $37 |

Refreshments/Break | $10 | $10 |

Travel Policy

The university will pay for the most economical form of transportation to reach your business destination and return. That will often be by air for out of state business. If you elect to travel by car, that’s a personal choice and your reimbursement will be limited to the lowest cost. You will have to provide a cost comparison which includes airfare and all related air expenses (airport parking, taxi from airport to hotel and back, and mileage from home to airport and return), and car mileage and related costs (including additional work hours for travel time) for the travel to the destination and return. This cost comparison, including the additional work hours for travel time, must be discussed and approved by your supervisor prior to travel.

Note: The comparisons will need to be attached to your expense report to support the elective to drive vs. fly and expedite your reimbursement.

For more information see the process guidelines: Determining the Appropriate Mode of Transportation and 1201 Purchase & Payment of Business Air Travel

There are a number of things to consider in this situation, for instance, can you pay to ship the equipment and travel by the lowest cost transportation option? Is it less costly to drive your personal vehicle and carry the equipment with you? Can you rent a car for less than the mileage cost for driving your own vehicle? The university will pay for the most economical form of transportation to reach your business destination and return, including the need to transport the equipment.

You will need to prepare a comparison of the various possible methods of transportation that will meet the need in determining lowest cost. You should then discuss options and cost with your supervisor as the approving authority has responsibility for determining the most appropriate mode of transportation.

For more information see the procedure: Determining the Appropriate Mode of Transportation

UW System Travel FAQs

Training

Topics: General Booking | Travel Policy | Air | Car | Lodging |Workday Expense | Credit Cards | Expense Reports | Funding | Spend Authorizations | Roles

General Booking

Please see Student and Guest Travel

Yes, the university’s contracted travel agencies can assist with companion/family travel. However, please keep in mind their primary responsibility is to service university sponsored/business-related travel. The consultants do not specialize in vacation travel. If your request exceeds their capacity, you will be referred to a vacation/leisure consultant. Also, keep in mind, service fees will apply to personal travel/companions.

It is the responsibility of the hosting department to ensure that all guests of the University are aware of UW Travel Policies. Guests should be provided a copy of the University’s Visitor Travel Guide prior to scheduling travel. If the guest books outside of policy, please reach out to your campus travel manager to inquire about obtaining an approved Travel Policy Exception.

There are several different types of insurance available to UW Employees. Please reach out to your Human Resources Representative for more information.

Insurance that is specific to travel –

- Vehicle coverage through the Big Ten contract (Enterprise and National) and State of Wisconsin contract (Hertz)

- CISI – medical insurance required for students who are traveling internationally. UW-Stout and UW-Madison employees are required to register for CISI insurance when traveling abroad. Contact your campus travel manager for more information.

* The University does not pay for or reimburse trip insurance.

We have created a Group Travel Resource page to identify the different needs of groups. Most likely, you will have to work with an agent, as agents are best to assist your group needs. Information on groups can be found in Group Travel under Planning in TravelWIse.

Concur

Concur is an online booking tool that University of Wisconsin System employees can use to book university-sponsored individual air, car or hotel reservations. Our contracted travel agency, Fox World Travel, licenses Concur for University Travelers to use. Travelers can manage their itinerary, view changes, and research pricing by using Concur.

Employees with an active Workday profile will be automatically registered for Concur. To sign in, follow the SSO link found on wisconsin.edu/travel.

We generally advise to only book State Government Rates for the state in which you are an employee. This means to only book state government rates for hotels in Wisconsin. You can also call the hotel to check to see if they will allow you to book the state government rate if you are not an employee of that state.

Concur cannot be used for personal travel reservations, unless purchasing business travel combined with personal travel. Cost comparisons may be required when booking air travel.

Training

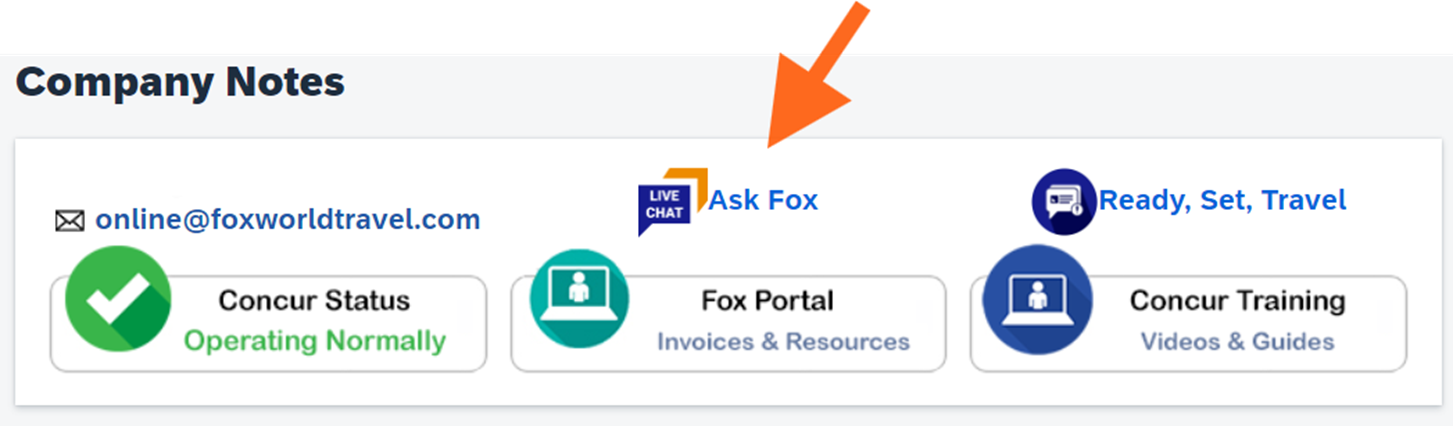

Fox World Travel Concur Support Desk

Fox World Travel is available to support your Concur questions. Contact support via phone at 608-710-4172, via email at online@foxworldtravel.com or via chat in the Concur application.

Additional Support

Contact your institution’s travel manager for additional support questions.

Personalized SAP Concur Open Updates

Personalized up-to-the-minute service availability and performance information

-

OPI-6188291 : US2 : Travel : Root Cause Analysis

11 February 2026 | 12:24 pm

Impact as Reported: Some New Concur Travel customers were unable to perform successful travel searches. Our internal monitoring tools measuring successful travel submissions detected a 95% drop in travel submissions. Further investigation confirmed impact to successful travel submissions was caused by an error, "Sorry something went wrong" when attempting to perform an air, car, and hotel travel search. If you experienced impact, you may have been able to successfully perform a search by trying again Root cause: A service configuration update reducing a session timeout for a travel service connections to a central database with the intent of implementing better session management inadvertently resulted in increased session termination and creation, leading to excessive load on the target database and consequent degradation for all services connecting to it. The change was reverted to restore service to normal. Corrective Actions: The following corrective and preventive actions have been identified: The configuration change has been reverted; The pre-release testing is being revised to ensure appropriate load is applied to detect this type of potential issues.

-

OPI-6182038 : US2 : Travel : Root Cause Analysis

11 February 2026 | 12:18 pm

Impact as Reported: New Concur Travel users experienced an issue completing travel bookings. Affected users may have encountered the following error when attempting to complete their travel booking from the Review and Book page, "Sorry, something went wrong." There was no workaround identified during service disruption. Root cause: A zero downtime patching operation on a vendor managed data store unexpectedly resulted in a temporary loss of connectivity resulting in degradation for services depending on it. Service returned to normal once the operation completed. The vendor has indicated that the issue likely was the result of the operation happening while the data store was under high load and has provided recommendation that are being implemented as preventative actions. Corrective Actions: The following preventative actions have been identified: The zero downtime patching process has been updated to restrict execution to low traffic times and to include validations to ensure no large workload is being processed when the operation takes place; The interval between database connection retries has been increased to reduce the chance of saturating the number of available connections.

No. Because of our commitment to duty of care and our relationship with vendors, UW will still require the use of our contracted travel agency partners for all airfare purchases.

No, UW air contracts cannot be used for travel that is 100% personal in nature. However, when combining personal travel with business travel, UW air contracts can be used.

Yes, travelers can combine personal and business travel and book individual tickets through Fox World Travel. When a traveler elects to combine personal travel days with business travel, a cost comparison may be required.

Valid Cost Comparisons: Concur or agents from one of the university’s contracted travel agencies must be used for cost comparisons. Because of pricing and availability fluctuations, accurate cost comparisons must be done immediately at the time of booking, in succession, to be valid.

No, companions/family members are not eligible to receive UW contracted airline discounts.

National/Enterprise and Hertz are the contracted suppliers for UW. See: Ground Transportation

Personal use may be added in conjunction with a business trip, either at the beginning of the end of your reservation. Please note additional coverage such as CDW or LDW are not included when reserving a strictly personal rental. The coverage can be added for additional fees.

View the Personal Use Contracts page for more information.

Users are highly encouraged to book all vehicle rentals through Concur or our contracted travel agency partners as contract details are built into the booking channels. However, booking directly with a vehicle rental agency is allowed. When booking outside of Concur/contracted travel agencies, it is the responsibility of the traveler/arranger to make sure the contracted vendors are being used (Enterprise/National and Hertz).

Verify hours of operation at the location you are renting from. It is possible that the location is closed at the time you are entering into Concur.

Note: pick-up and/or drop-off hours may need to be modified to accommodate the location hours of operation.

If you have determined that no in contract rental cars are available, explore other options. Look into renting from National or Hertz, and if none of our preferred partners have availability you may want to condenser driving your personal vehicle or work with our travel agency to use another vendor. Insurance must be purchased when renting from a non-contract vendor.

Contact your campus travel manager for assistance in determining the best alternative.

Yes.

Note: Most Airport locations are open on weekends.

Yes. While we highly recommend using Concur or our contracted travel agencies, policy does allow you to contact the hotel directly (either by phone or on the hotel website) to book your lodging reservation.

No. Third party booking websites are prohibited under the travel policy

Yes.

Third Party bookings are still restricted (such as Expedia and Orbitz).

Please visit our Airbnb page for more information.

Conference lodging should be booked using the link provided with your conference registration or by contacting the conference hotel directly.

Note: Users are highly encouraged to search Concur for the conference hotel(s) as often rates found within Concur are less costly than the conference rate.

We highly encourage you to use UW preferred properties whenever possible. Booking with a preferred property allows the UW System to act as a liaison in the event there is an issue with your stay, and to ensure rates are below the maximum. However, bookings with non-preferred properties will still be reimbursed.

If you are unable to find lodging within a reasonable distance from your location, you are required to provide documentation (i.e. screenshots from Concur) that a lower rate was not available.

Purchase Card transactions will be reconciled with expense reports, as will Corporate Card transactions (also known as Shared Liability card).

Transactions ready to be expensed appear in the worker's Expenses Hub, as well as in the Timely Suggestions area on their Workday home page. Weekly alerts will also be emailed to workers who have open transactions needing to be expensed.

The "UW Credit Card Fraud" expense item is used for this purpose. In general this should be used only when this item has been or will be reported as “fraud” and not something that will ultimately be expensed. It is recommended to have both the “charge” and the “credit” will be on the same expense report to offset, if possible.

Note: This only reconciles the charge in Workday, this does not replace the required fraud reporting procedures. Refer to the cardholder policy manual for proper fraud reporting procedures.

Each card appears in the worker's profile under the Company Property section. Each card is labeled with the worker's name and the type of card (Purchase Card or Shared Liability Card). There is also a unique 4-digit number listed for each card (this is a unique ID, not the actual last 4 digits of the credit card).

An Expense Data Entry Specialist would be able to submit the expense report on behalf of the terminated employee.

Purchasing Card credits can be reconciled the same as any other Purchasing Card transaction. Shared Liability (Corporate Card) credits cannot be submitted unless there are sufficient positive expenses to offset them (i.e.: users cannot submit an expense report with a net negative amount on their Shared Liability Card). Shared Liability cardholders should contact their Credit Card Administrator to resolve large or old credit balances. Credits cannot be directly linked to the original expense.

All transactions will need to be reconciled in Workday, regardless of fraud or dispute. Disputed transactions can be identified using the additional worktag, "UW Card Transaction Pending Vendor Review/Action" to notify downstream approvers the transaction is being disputed (Additional Worktags > Expenses Reporting). Cardholder must still call US Bank Customer Service to dispute the transaction. When this additional worktag is used, the employee (and initiator if applicable) of the expense report will receive a to-do step once the expense report is approved. The to-do step will request additional context be provided once the dispute has been resolved.

Transactions are loaded into a Workday expense report in USD, regardless of the type of currency that was paid. Cardholders can view the Workday report, "My Expense Transactions" to view the Transaction amount (currency charged) as well as the Billing amount (converted USD amount).

Monthly limits listed in workday in the Account Information area will be correct for all Shared Liability Cards, as they do have a monthly limit. For all Purchase Cards, the limit shown is actually only the two week cycle limit, and not the “monthly limit” as noted. This is a limitation in Workday and cannot be changed at this time. The Transaction Limit amount is correct for both card types.

Example: The tab says 2 transactions, however, 3 credit card transactions are listed. This is because 1 of the transactions has been pulled into an expense report that is in progress and is not available to be pulled into a new expense report. Once the expense report with the credit card transaction has been completed and settled, the transaction will no longer appear on the list.

Additionally, if the pending expense report with the transaction is cancelled prior to being settled and paid, the transaction becomes available to pull into a new expense report.

No. Currently US Bank is refunding any late fees incurred through the end of October on Shared Liability cards. UW Purchasing cards do not have any late fees, as they are automatically paid. Employees are encouraged to plan accordingly for longer turnaround times expected through early November and submit expense reports timely to avoid any late fees.

Alerts and errors appear next to the expense item listed on the left of your screen (alerts as an orange diamond, errors as a red circle). If you then go to the upper right-hand side of your screen and click the orange or red rectangle, you will see what the alert and/or error is. Some nuances:

1. Most alerts & errors are triggered at the line level telling you there is something wrong with the specific line. Others (ex: if you use a business purpose that is only allowed on spend authorizations) apply to the entire expense report. Those will still fire and have the error message visible through the link at the top-right of the screen, but they will not put an orange diamond or red circle next to any of the individual lines.

2. If the expense line is itemized, you may see an error repeated. Workday, in a way, treats each itemized line as its own expense. For example, if you split the expense into two separate itemized lines, you’ll get 3 errors – once for the “main” expense and once each for the itemized lines.

Once in the itemization area, click the trash can icon on the top right corner. This will cancel the itemization, and/or delete one itemization at a time (will need to repeat this action for multiple splits). Click Done when prompted.

Per Workday Community, Maximum Attachment Size is 30,720 KB (30 MB) and the Maximum Image Size is 10,240 KB (10 MB)

Once the correction is made click elsewhere on the expense report (ex: a different expense line, or the header tab) so that the expense report will refresh. In most cases, the error will disappear after the refresh, however, some soft alerts (orange error) will remain to alert approvers while they are reviewing. Expense reports can be submitted when there are soft alerts, but cannot if the error is a red error. Red errors must be corrected before the expense report can be submitted.

The guidance recommended is to manually add all attendees if the total number is under 25. If over 25, then an attendee list can be attached instead (with the Number of Persons field updated to reflect the total number of attendees). This guidance was discussed with UW System leadership.

Note: It is advised to enter attendees BEFORE itemizing an expense line, otherwise you will have to enter them multiple times. For student attendees, it is recommended to manually list all for reporting purposes.

There is no minimum or maximum for this field.

Each expense report has a "Business Process" tab that shows the approval history.

To modify an expense report, enter "My Expense Reports" in the search bar > click Actions next to the expense report you'd like to change > choose Edit Expense Report from the dropdown menu > make the necessary changes to the expense report and submit.

Note: You cannot edit an expense report if it has a payment or pending payment applied to it. If the expense report was in progress (in the process of approval) the approval process will restart if the expense report is changed. It may be necessary for the employee and/or the Expense Data Entry Specialist to "re-approve it" when it re-enters the approval process.

To cancel an expense report, enter "My Expense Reports" in the search bar > click Actions next to the expense report you'd like to cancel > choose Cancel Expense Report from the dropdown menu > click OK.

Note: Canceling an expense report is irreversible. You cannot cancel an expense report if it has a payment applied to it.

No, the worker will need to go to their Expenses Hub, then click Expense Reports, and view the status. If it's in draft status, it was never submitted. Expense Reports that have been sent back will be included in a weekly alert as well as an email on Monday mornings.

There are multiple ways to add a receipt to an expense report.

1. Receipts can be added at the header level or the expense line level in expense reports.

2. Quick expenses are added using the mobile app, may include a receipt, and can be pulled into expense reports at a later date.

3. Receipts can be emailed to Workday from the email address(es) in your employee profile, and will appear as a quick expense that can be pulled into an expense report. Receipts can also be emailed to another employee's Workday profile.

This is correct. Per diem policy is changing with the Workday rollout, and no longer requires a first and last day deduction.

It is somewhat similar - they are called either an External Committee Member (a non-employee) or if they were a candidate, they would have a "shell profile" already in Workday as a candidate or pre hire. The Expense Data Entry Specialist can create expense reports for these classifications (External Committee Member, candidate or pre-hire are the three categories).

As part of travel policy changes related to the Workday rollout, mileage is now one rate. There won't be separate standard, turndown or motorcycle rates.

You will still need to attach a copy of an Oanda currency conversion to your expense report for reimbursements that were originally paid in foreign currency. However, the attachment will not be required when reconciling UW credit card transactions as they are automatically converted when coming into Workday.

The new travel policy only require receipts at $50.01 and above for out of pocket expenses (and shared liability card transactions). For all Purchase card expenses, receipts will always be required.

Expenses incurred on or after March 11th, 2025 are able to be submitted in an expense report until Sept 30th, 2025 without tax penalty. Expenses incurred during this period are not subject to the 90 day Accountable plan policy until Oct 1st, 2025. After October 1st, Accountable plan exceptions are handled via a Spend Authorization.

This field is the number of people in a room times the number of nights. For example if 2 people shared a room for three nights, the total number of nights private accommodation you should enter is 6. This calculation is what determines if the expense is in policy or over the maximum rate for that location.

If you do accidentally hit “submit” you can go back to your Expenses Hub, find the expense report, click on Actions, and Change your Expense report.

Per policy, HIPAA protected research participant costs must not be processed in the Workday Expenses module.

- Payments to HIPAA protected research participants, including the payment of reimbursable travel expenses, are processed via an Ad Hoc payment or Advara.

- Payments to Non HIPAA protected research participants are processed via an Ad Hoc payment.

- Travel expenses for Non HIPAA protected research participants are processed via an expense report.

Out-of-policy expense reports will require an approved Spend Authorization be linked (with Expense Operations Lead approval) to the expense report, to document that approval has been given to proceed with an expense report.

The Expense Data Entry Specialist (EDES) has the ability to create expense reports & spend authorizations on behalf of other employees and non-employees. EDES's are required to be trained before receiving this role. Unlike SFS, EDES's are not assigned to specific individuals; once assigned the role, an EDES can create spend authorizations & expense reports for all employees and non-employees. Additionally, the EDES can request the setup of a non-employee (aka External Committee Member). EDES's cannot approve expense reports or spend authorizations they created themselves; the Cost Center Manager is used as a backup in that situation.

Central Audit, also known as the Expense Partner pool, reviews expense reports for UW-level policy compliance. In most cases, they are the first level of review for an expense report.