UW System President Ray Cross is calling for public and legislative support for its 2017-19 biennial budget proposal, which is aimed at helping keep college affordable for the approximately 180,000 students who attend a UW institution each year.

“College affordability is a top priority for Wisconsin families. We help our students through financial aid counseling and assistance, but we want to do more to help them graduate faster while maintaining the excellence our universities are known for. It’s time to invest in the university system so our students get the help and resources they need,” said UW System President Cross.

Out of the approximately 180,000 students who attended a UW institution in the 2014-15 school year:

- 26% graduated with a bachelor’s degree without loan debt

- 123,103 total UW System students received financial aid

- 47% total students received a grant

- 5% total students received a work-study award

In his call to action, President Cross is pointing out the real numbers in the affordability picture:

- The undeniable value of a UW System education

- Wisconsin’s actual financial aid and student loan debt picture

- Solutions the UW System is offering in its 2020FWD plan to help students and families

The UW System’s 2020FWD strategic framework provides the basis for the UW System’s 2017-19 biennial budget request of $42.5 million and provides solutions to help address college affordability while building the workforce of tomorrow – the two biggest concerns voiced by more than 5,000 citizens, community leaders, and business owners across the state during the UW System’s listening sessions over the past year.

Value of a College Education

Wages

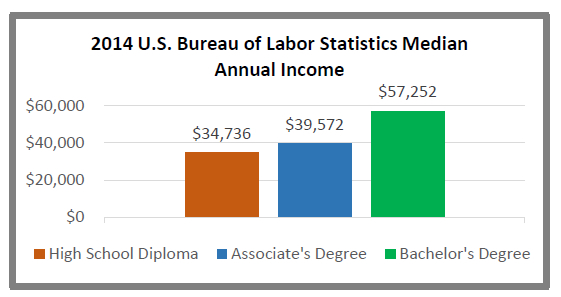

“The value of a UW System education is undeniable. According to Kelley Blue Book, a new car averages $33,666 and it depreciates as soon as you leave the lot. Students graduate from the UW System with debt that averages less than the cost of a car, but earn about $1 million more over their lifetime than someone with a high school diploma,” Cross said.

According to the U.S. Department of Education, on average, a college graduate earns $1 million more over their lifetime than a high school graduate.

Recession Resistant

A college education can also help significantly during difficult economic times. According to a study conducted by the Georgetown University Center on Education and the Workforce, workers with a high school diploma or less lost 6.3 million jobs during the Great Recession – and very few of those jobs have come back. Here’s what the study had to say:

- “…the number of jobs requiring at least a bachelor’s degree did not decline during the Great Recession and has exploded in the recovery. Today, there are 8.1 million more jobs for Americans with a bachelor’s degree or above than existed when the recession began. Virtually all job growth in the U.S. since 2007 is in jobs requiring some form of postsecondary education.”

- “….But this is not just about jobs. Success in postsecondary learning determines whether Americans can buy homes, pay for health care, and save for retirement and their children’s education. Just as important, Americans who hold postsecondary credentials are more engaged in their communities — voting and volunteering at higher rates and showing greater appreciation for diverse cultures.”

Impact on Wisconsin’s Economy

The UW System has at least a $15 billion impact on Wisconsin’s economy each year. For every $1 the state invests through general purpose revenue (GPR), it gets at least a 10-1 return on investment (Northstar Consulting).

85% of UW System graduates stay in Wisconsin

In addition, 85% of individuals who graduated from the UW System with bachelor degrees in 2011-12 still live in Wisconsin. “Those individuals are here contributing to our society, paying taxes and keeping Wisconsin a great place to live,” Cross said.

Wisconsin’s Financial Aid and Student Debt Picture

College affordability includes five components: (1) tuition, (2) time to graduate, (3) state funding, (4) financial aid, and (5) operating efficiencies. State funding has been cut significantly over the past six years and is at an all-time low and financial aid has been frozen, despite the efficiencies the UW System has achieved. The UW System 2020FWD plan helps students graduate more quickly so they spend less on tuition, while also helping high school students come into the university system with more college credits under their belt. The Board of Regents has also approved a request for an increase in financial aid that goes directly to students.

“State and federal financial aid continues to decline. When you freeze tuition, freeze financial aid, and cut state funding, you chip away at the money used to help ensure we can offer the classes our students need. When you cut classes, it takes longer to graduate. While freezing tuition may save a couple hundred dollars a year, students and families may end up paying more in the long run,” said President Cross.

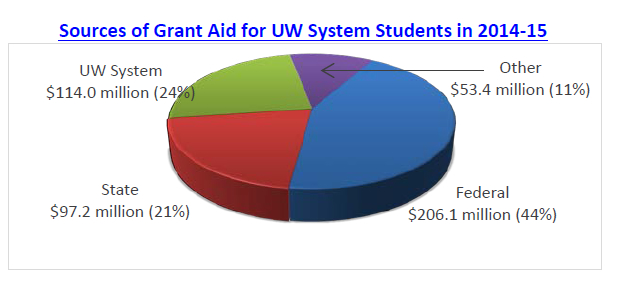

Grants

State funding for the Wisconsin Grant Program has remained flat at $58.3 million since the 2010-11 academic year. In turn, the average grant award amount has fallen from $2,161 to $1,773 to address the increase in the number of students who need financial aid.

In June 2016, the Board of Regents recommended increasing state funding for financial aid by $19,152,300 for the 2017-19 biennium. The Wisconsin Higher Educational Aids Board (HEAB) would provide this funding directly to students.

| WI Grant Awards to UW System Undergraduates Available to Wisconsin Residents Only |

||

|---|---|---|

| Year | Recipients | Average Grant |

| 09-10 | 25,624 | $2,161 |

| 10-11 | 30,344 | $1,962 |

| 11-12 | 30,675 | $1,901 |

| 12-13 | 31,758 | $1,835 |

| 13-14 | 32,880 | $1,773 |

| 14-15 | 32,885 | $1,773 |

Student Loans

In the 2014-15 academic year, 26% of students who graduated the UW System with a bachelor’s degree graduated with no debt. The other 74% of students who graduated with student loans had an average debt of $30,650.

The Institute for College Access and Success (TICAS) 2014 report on student debt reports that the average debt at Wisconsin public and private non-profit four-year institutions is $28,810, making Wisconsin 17th in the nation. The national average was slightly higher at $28,950.

“While we help educate our students about their financing options so they can graduate with as little debt as possible, more students are taking out loans because Wisconsin’s financial aid has been frozen and there’s simply more students who need financial assistance,” said President Cross. “Of course, students would prefer to use grants to pay for college, but when federal and state funding declines, it makes college more expensive for students and expands their reliance on loans to finance their education.”

According to the UW System Student Financial Aid 2014-15 Informational Memorandum, the federal government provided 89% of student loans. Over time, students have been relying more on federal unsubsidized loans, as well as loans from private banking institutions. Unsubsidized loans and private loans have risen by 12% over the past ten years and now comprise 67% of student borrowing, or $585.2 million.

Default Rates

According to the U.S. Department of Education:

- UW System’s student loan default rate of 4.6% is significantly lower than the national, state and surrounding Midwest

- The national student loan default rate averages 11.8%

- Wisconsin’s statewide rate (including for-profit colleges) is 9.2%.

- Wisconsin’s default rate of 9.2% is lower than all the surrounding Midwestern states

| Average Student Loan Default Rates for Students in Repayment | ||||

| WAICU Colleges Only | UW System Only | Overall Wisconsin Average | National For-Profit (Proprietary) Colleges | United States |

| 4.4% | 4.6% | 9.2%** | 15.8% | 11.8% |

Notes:

Sources: U.S. Department of Education – Office Student Financial Assistance Programs, UW System, WAICU |

||||

| Average Student Loan Default Rates for Students in Repayment | ||||||

| UW System | Wisconsin (includes for-profit colleges) |

Illinois | Iowa | Michigan | Minnesota | Ohio |

| 4.6% | 9.2% | 10.1% | 13.1% | 12.8% | 9.8% | 14.6% |

| Sources: U.S. Department of Education – Office Student Financial Assistance Programs, UW System, WAICU | ||||||

Solutions to Help Students and Families

All institutions have financial aid experts to assist and counsel students about their financial aid options. In addition to recommending an increase in state financial aid by $19,152,300 in the 2017-19 biennial budget, the UW System has included the following solutions below to help students in its 2020FWD strategic framework:

- Strengthening The Educational Pipeline: help students at all points in the educational pipeline – from early childhood through secondary school, college, and lifelong learning. The UW System will partner with other educational entities and local communities to help maximize the number of students who enter and remain in the educational system, including those from underrepresented groups. It will also develop policies and adopt practices that will help UW students graduate more quickly in order to reduce the cost of their education. This includes managing academic courses and programs offered at institutions, as well as regularly reviewing standards and practices supporting the collaborative management of electives and enrollment.

- College Options Program: provide more opportunities for students to complete college coursework while in high school – often called dual enrollment – so they come into the UW System with more college credits under their belt, including finding ways to deliver these courses in small high schools and in rural areas.

- 360 Advising: improve student success and reduce time to degree by expanding the use of predictive analytics, intensive advising, and other advising practices that provide timely support to students. The UW System will also strive to increase student access to career counseling and financial planning.

- Seamless Transfer Opportunities: expand the Transfer Information System (TIS) to increase both the number of articulation agreements between colleges and increase the number of participating higher education entities. The transfer process should be seamless, smooth, and easily navigable for all students at any step of their educational journey.

- New Traditional Students: expand opportunities for adult/non-traditional students to complete a degree through a variety of adult learning programs, including its competency-based online UW Flexible Option program.

- Wisconsin Workforce Needs: add and/or expand specific academic programs in areas needed in the Wisconsin workforce. In addition, the UW System will raise awareness with students about high-demand fields with current and prospective students.

“Funding these initiatives will continue to enhance the UW experience, give students the critical resources they need, and build our workforce of tomorrow,” said President Cross. “Our budget request is reasonable – we believe these programs are important and deserve state funding. While we still have those who say we’re not asking for enough because of the unprecedented cuts made in the past six years, we want to move forward and focus on solutions for our students and families.”