Background and Basics

A 403(b) plan is a retirement savings program authorized by section 403(b) of the Internal Revenue Code for employees of educational institutions, churches, and certain non-profit agencies. It allows eligible employees to set aside up to virtually 100% of their income for retirement.

In the UW 403(b) Supplemental Retirement Program (SRP) participation is voluntary. You make the entire contribution, and there is no employer match. For most employees, the University of Wisconsin contributes to the Wisconsin Retirement System (WRS), the state’s primary pension plan.

All permanent, project, and Limited Term Employees (LTEs) of the University of Wisconsin as well as rehired annuitants, student hourly employees, and graduate assistants – with the exception of some employees-in-training, fellows, and interns – are eligible to participate.

Eligible employees can enroll at any time.

The UW 403(b) SRP Advisory Committee (SRPAC) is a nine-member committee appointed by the UW System President that provides oversight of the program and advice on program issues. Appointees may come from faculty, academic staff, university staff and limited appointee employee categories, and retired participants. The normal term for each appointment is three years, and appointments are staggered to provide continuity to the function of the SRPAC.

The current SRPAC membership is listed on the UW 403(b) SRP website wisconsin.edu/ohrwd/benefits/download/403(b)_Committee_Members.pdf

In 1977, the University of Wisconsin Board of Regents established the Tax-Sheltered Annuity 403(b) Plan along with the TSA Review Committee (TSARC) to provide oversight. In 2020 through 2021 the program was reviewed for updates and enhancements with the following goals:

- Offering leading provider(s)

- Providing proven investment options

- Making it easy to enroll, select investments, and monitor investment performance on an ongoing basis

- Communicating with participants in a simple and engaging manner

Part of the program review was to determine if UW Tax-Sheltered Annuity (TSA) 403(b) Program was still an appropriate name since many people now associate TSA with airport security. In 2022 the 403(b) Program was restructured to provide a set investment line-up from two providers, TIAA and Fidelity, and the name of the program was was changed to the 403(b) Supplemental Retirement Program (SRP) and the name of the oversight committee was changed to the UW 403(b) SRP Advisory Committee (SRPAC).

Benefits and Contributions

There are four important reasons to participate in the UW 403(b) Program:

- It's an easy way to accumulate additional savings you will need to supplement your retirement income.

- You can make either pre-tax or Roth after-tax contributions or a combination of both options.

- It is a flexible, low-cost program with a wide array of investment options.

- It’s portable. You can take your savings with you if you move to a different employer.

Retirement is expensive! Your WRS pension and Social Security will provide only part of what you will need, and the rest must come from personal savings.

On top of that, people are living longer. And instead of working longer most of us would like to retire earlier. Some of us may even be retired longer than we will have worked! That is a fine goal, but we must figure out a way to pay for it.

No. We all have diverse investment objectives that must be met with different investment techniques. The investment objective for the UW 403(b) SRP account is retirement security.

If you buy shares of a mutual fund with non-403(b) dollars, you owe taxes each year on the dividends and capital gains your fund realizes. If you sell one fund and buy another, you owe taxes on the profit.

In a 403(b) investment, you get to keep and invest the tax money you would otherwise owe each year. The extra dollars produce more earnings. You can shift your money among funds without incurring fees or capital gains taxes. Though you must pay income tax on the money you withdraw from your SRP pre-tax account, your net return will be higher than with a taxable account earning the same return. A qualified distribution from a Roth after-tax 403(b) SRP account is tax-free.

It is never too early to start saving for retirement! Take a close look at your budget and consider the hypothetical scenario below.

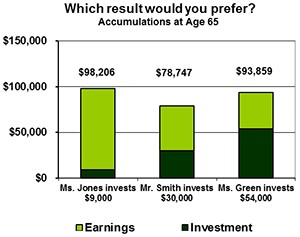

- Jones contributes $75 per month for ten years – from age 25 to 35 – and nothing after that.

- Smith starts later but contributes more – $100 per month for 25 years, from age 40 to 65.

- Green begins saving $300 per month at age 50.

Assuming that all the investments earn 7% per year, this chart shows their total accumulations at age 65.

Chart Summary

Name Invested Earnings

Ms. Jones $9,000 $89,206

Mr. Smith $30,000 $48,747

Ms. Green $54,000 $39,859

In this example, investing a small amount early resulted in more retirement earnings than investing a much larger amount later. Because of compound interest, the money you contribute now is very valuable. Keep your long-term goals in mind and decide what's truly important to you.

There are lots of resources available to give you direction on how to budget your money and how to find the money to save. You can start by looking at the investment companies’ web sites in the SRP Program.

Dollars and Sense

The University has negotiated low-cost investment options:

- All funds are no-load: there are no sales commissions or broker fees.

- Participants have access to low-cost institutional share classes through the core line-up, and most investment choices have lower than average expense ratios.

- You can move your investments within the SRP Program without incurring tax liabilities.

Your UW 403(b) SRP account is a long-term savings vehicle to be used for retirement. IRS regulations limit the access you have to your savings. You may withdraw your contributions only when you leave employment with the UW System, reach age 59 ½ – even if you are still working for the UW, or become disabled. Hardship distributions that meet federal requirements are also allowed.

Withdrawals before age 59 ½ may result in tax penalties. As long as you terminate UW employment at age 55 or older – even though you are not 59 ½ – you may take distributions from your UW 403(b) SRP account without being subject to the 10% tax penalty for early withdrawal.

You can initiate a withdrawal from either TIAA or Fidelity over the phone or online – just log onto your UW 403(b) Program account. You can also use a paper distribution request, if you wish. The UW 403(b) Plan Administrator’s signature is not required on the TIAA or Fidelity form.

Here is the TIAA and Fidelity contact information:

- TIAA

(800) 842-2776 - Fidelity Investments

(800) 343-0860

Loan services are available from current UW 403(b) SRP providers TIAA and Fidelity, as well as the frozen providers Ameriprise/RiverSource and Lincoln, for participants who have assets with either those two companies.

Contact your UW 403(b) SRP company to initiate a loan. Each company has its own loan procedure. Only two outstanding loans are permitted at any time, even if you have accounts with more than two investment companies.

Under IRS regulations, the maximum amount you may borrow is the lesser of $50,000 or one-half of your account balance. You must start to repay your loan right away, and it must be fully repaid within five years unless the loan is used to acquire your principal residence.

Pre-Tax Accounts

The money from pre-tax accounts that you withdraw is taxed as regular income to you in the year you receive it. For that reason, plan carefully how you take your distributions, so that taking a large distribution in one year does not put you into a higher tax bracket.

Roth After-Tax Accounts

You do not pay any federal or state income tax on the earnings realized from Roth investments, and since you have already paid taxes on the contributions themselves, when you withdraw the money, the entire account is tax-free – subject to IRS restrictions.

IRS Restrictions

In order to be excludable from gross income, or tax-free, your distribution must be a qualified distribution.

A qualified distribution is one that occurs at least five years after the year of your first Roth contribution (counting the first year as part of the five) and is made:

- On or after the attainment of age 59 ½,

- On account of the employee’s disability, or

- On or after the employee’s death (paid to beneficiaries)

What if I want to take money from my UW 403(b) SRP Roth account BEFORE I have met the Qualified Distribution criteria?

If you take a distribution from your Roth account before your Roth account has been open five years or before you are age 59 ½, the amount of the distribution that represents your earnings is includable in gross income and is taxable. The amount that represents your Roth contribution is not taxable.

As a hypothetical example, say your Roth contributions are $9,000 and your account value has grown to $12,000. Divide 9,000/12,000 = .75. If you want to take out $4,000, 75% of that or $3,000 (representing your contributions) is non-taxable, while $1,000 represents the earnings on those contributions and is taxable.

Future and Retirement

Yes, federal law permits you to transfer money from a 403(b) account to a governmental retirement plan to purchase service credits. If you have forfeited service in the Wisconsin Retirement System (WRS) and wish to buy it back, you can pay for it from your UW 403(b) SRP account. The Department of Employee Trust Funds administers the WRS. See the website etf.wi.gov or contact them at 877-533-5020 for more information.

If you leave employment at the University of Wisconsin System, you can:

- Leave your UW 403(b) SRP account as it is. It will continue to grow. Be sure to keep the company updated on home address changes and your current email so that you continue to get your quarterly statements of account.

- Withdraw your UW 403(b) SRP account and roll it into your new employer’s retirement plan, provided the new plan will accept the rollover.

- Withdraw your UW 403(b) SRP account and roll it into an IRA.

- Withdraw your UW 403(b) SRP account for your use. Please note: there may be substantial tax penalties if you are under age 59 ½! – If you have terminated employment at age 55 or later, there is no penalty. See above for IRS restrictions on Roth after-tax accounts.

When you leave employment with the University of Wisconsin System or reach 59 ½, your SRP investment is no longer restricted to the companies approved by the Program. At that time, you may take a distribution and roll your funds into any investment vehicle permitted by law.

When you die, your UW 403(b) SRP account is payable to your beneficiary on file with your 403(b) provider. You were encouraged to complete a beneficiary designation when you established your UW 403(b) SRP account. You can change the designation online with TIAA or Fidelity or by submitting a new paper designation. Make sure your beneficiary designation is up to date.

If you do not file a beneficiary designation, the investment company will determine your beneficiary in accord with “Statutory Standard Sequence” (a Wisconsin State law).

TIAA and Fidelity participants can update beneficiary designations through their online account or call the company to request a paper beneficiary designation and submit it.

See the UW 403(b) Supplemental Retirement Program section of the Beneficiary Designation webpage: www.wisconsin.edu/ohrwd/benefits/beneficiary/ for contact information for UW 403(b) Program frozen investment providers.

The forms of payment are very flexible. You can take your money in one or more lump sums, in a regular series of payments, as an annuity for a specific period of years, as a life annuity or as a joint and survivor annuity.

Even if you invested in an annuity product through the SRP Program, you do not need to take your money out in the form of an annuity. You can select any payout option you wish.

An immediate annuity is a regular payment to you (or to you and a joint survivor) for your lifetime(s) or for a guaranteed number of years (as opposed to a deferred annuity, which is an insurance product you contribute to). If you decide to take your UW 403(b) SRP account in the form of an annuity, you use your accumulated balance to purchase the annuity from an insurance company.

If you select a fixed annuity, you receive uniform monthly payments of a fixed dollar amount. The monthly payment will depend on your age, the amount you invest, and the payout design you elect. Your payments are guaranteed by the insurance company. If you select a variable annuity, the payout amounts are tied to changes in the market value of the underlying funds and may fluctuate. The value of a variable annuity and the number of payments is not guaranteed.

Even if you have been investing in a deferred annuity with a life insurance company, you do not have to take your money out in the form of an annuity (or monthly payment). If you do want an annuity, please be aware that you do not have to get that annuity from the same company you have invested with. Shop around and compare the results and expenses. It may save you thousands of dollars!

Yes, participants must adhere to the Required Minimum Distribution (RMD) rules as laid out in the chart below for pre-tax accumulations. RMDs are not required for Roth accumulations. If you are working for the University of Wisconsin, you do not need to take a Required Minimum Distribution from your UW 403(b) SRP account(s); however, if you have retirement accounts from other employers or an Individual Retirement Account, you may need to take an RMD from those accounts.

The information below incorporates changes included in the Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act, which became law in December 2022.

Age 70 ½ | For those born June 30, 1949, or Earlier | Anyone born on June 30, 1949, or earlier and is no longer working for the UW should have already started lifetime RMDs and is bound by the original age 70 ½ RMD rule. Continue to take your annual RMDs as normal. |

Age 72 | For those born July 1, 1949, through and including December 31, 1950 | Anyone born on July 1, 1949, through & including December 31, 1950 and no longer working for the UW, should have already started RMDs & is bound by the original SECURE RMD age change to 72. |

Age 73 | For those born January 1, 1951, through and including December 31, 1959 | Anyone born on January 1, 1951, through & including December 31, 1959, will use age 73 as their RMD age. Note: 2023 will be a year to adjust to the new age. Anyone born in 1951 will turn 72 in 2023. No RMD is required for these participants in 2023 because the rule is now age 73, and they won't hit 73 until next year. Accordingly, no one will have their very first RMD in 2023, because in 2023 there is a transition to the new RMD age. |

Age 75 | For those born January 1, 1960, or Later | This doesn't begin until 2033. |

Secure 2.0 also reduces the penalties associated with failing to take an RMD. If you neglect to take the distribution, you will incur a 25% tax penalty (reduced from 50%) on the minimum amount you should have received. The penalty will be further reduced to 10% if you take appropriate action. Your investment provider will calculate your minimum required distribution upon request.

Where do I go if I have a question that is not on this list?

Good question! Send an email to 403bsrp@uwsa.edu and someone will be able to help you!

Updated: 09/18/2023